Is Netspend Safe? Avoid Scams & Fraud - Expert Guide!

Are you confident in your financial safety, or do you feel like you're constantly dodging digital bullets? Understanding the intricacies of prepaid cards, particularly those offered by Netspend, is essential to safeguard your hard-earned money.

Communication is a key part of how Netspend protects its customers from fraud. Netspend utilizes an integrated voice response (IVR) system, meaning you can address fraud queries without waiting for an agent, with 24/7 accessibility. The Netspend Visa prepaid card, alongside its Mastercard counterpart, can be used wherever Visa or Mastercard debit cards are accepted, offering a seemingly convenient alternative to traditional banking.

However, the realm of prepaid cards is not without its shadows. This article delves into the Netspend ecosystem, exploring its functionalities, potential pitfalls, and the experiences of users who have navigated its complexities. We aim to provide a balanced perspective, helping you make informed decisions about your financial tools.

Netspend, founded in 1999, stands as a major player in the prepaid card market, offering both Visa and Mastercard options. They provide various prepaid debit card solutions tailored for individuals and businesses. The "Netspend Better Credit Visa Card" is a secured charge card issued by Pathward, National Association, a member of FDIC. However, the user experiences paints a different picture. A user recounts being with Netspend from 2010 to 2016, receiving direct government deposits, only to have their card blocked due to alleged debt dating back to 2010. This is a concerning situation which raises questions about the reliability of such financial tools.

| Category | Details |

|---|---|

| Company Name | Netspend |

| Founded | 1999 |

| Headquarters | Austin, Texas (as per some sources, though not definitively stated in all information.) |

| Industry | Financial Services, Prepaid Cards |

| Key Products | Prepaid Visa and Mastercard debit cards, Business prepaid card solutions, Netspend Better Credit Visa Card |

| Key Features | Reloadable prepaid debit cards, Option to save and earn interest (on certain cards), Direct deposit capabilities, Integrated voice response (IVR) for fraud inquiries. |

| Target Market | Individuals seeking alternatives to traditional banking, those without bank accounts (unbanked or underbanked), businesses. |

| Parent Company (If applicable) | Global Payments Inc. (previously TSYS) |

| BBB Rating (Example, subject to change) | Varies, often not consistently excellent. (Check Better Business Bureau website for current ratings.) |

| Official Website Link: | Netspend Official Website |

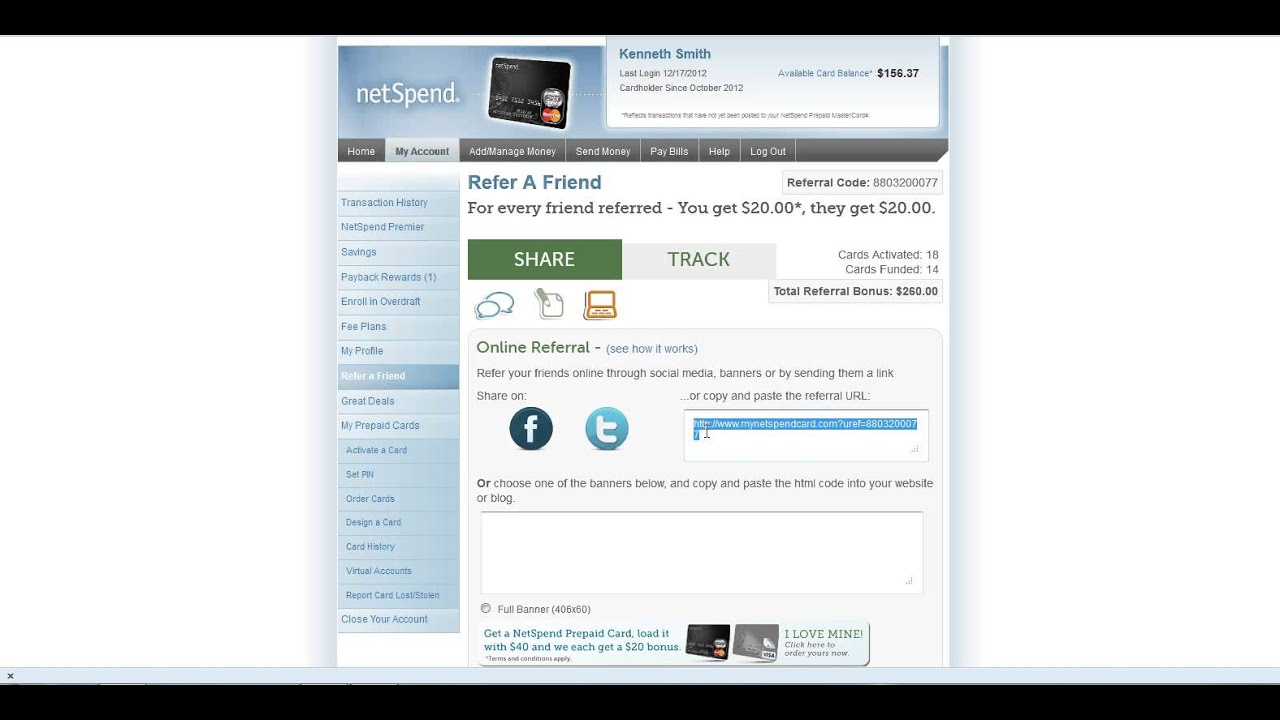

Netspend's marketing often touts immediate access to funds and guaranteed card approval, claims which have been scrutinized by the Federal Trade Commission (FTC). The FTC has previously filed complaints against Netspend, highlighting discrepancies between marketing promises and actual customer experiences. These complaints often centered around consumers finding their funds not immediately accessible and encountering difficulties with card activation or access. This discrepancy is a red flag for any potential user.

Activating your Netspend card is a crucial step, but its equally important to prioritize security during activation. Fraudsters frequently employ deceptive tactics to steal personal information. It is crucial to be vigilant and avoid any suspicious links or requests for sensitive details. Always verify the legitimacy of the source before providing any information. Be wary of unsolicited cards or emails asking for you to activate your card.

Several Netspend users have reported receiving cards they did not apply for. Some have received cards that can only be used in limited locations. This raises concerns about potential fraud. Some users find it impossible to activate the card, and the lack of responsive customer support intensifies frustration and a sense of being scammed. It is important for consumers to exercise caution, research a company before doing business with it, and protect personal information.

The Netspend prepaid card is a reloadable prepaid debit card, offering a convenient alternative to traditional banking. Users can load funds at various locations, from grocery stores to gas stations. The Netspend card offers basic debit card features, plus an option to save and earn interest. The Netspend Premier card, for instance, offers more features. But, it is important to be aware that fees can get steep if you are not careful with how you use them.

The Netspend Visa prepaid card may be used everywhere Visa debit cards are accepted. The Netspend prepaid Mastercard can be used anywhere debit Mastercard is accepted. However, it is important to be aware of the limitations and associated fees that may come along with them. Another point to consider is the customer support system. Several reports note the lack of readily available customer support. The potential for delayed resolutions can create additional stress and frustration.

The FTC has taken action against Netspend, resulting in a settlement requiring them to notify and provide refunds to eligible customers who requested them before a specific date. This settlement demonstrates the importance of regulatory oversight in the financial sector, aimed at protecting consumers from misleading practices.

If you receive a Netspend card in the mail without applying for it, you are not alone. It could be an offer, but it's also a situation where caution is necessary. Never provide personal information to an unsolicited source. Always carefully scrutinize the documentation, looking for any hidden fees or unclear terms.

Prepaid debit cards can be useful financial tools. However, like any financial product, they come with both advantages and disadvantages. In the case of Netspend, users should carefully weigh the benefits against the risks, particularly regarding customer service, fee structures, and potential for fraudulent activity. Always protect your personal and financial information, and stay informed about the latest scams to safeguard your financial well-being.

The prevalence of scams and fraudsters means vigilance is key. Scammers often try to steal personal information. This article hopes to give you information to protect yourself from fraud.

Before selling your house for cash, think about how to protect yourself from credit card theft. Consider doing this to get some more security when you sell your house.

This is an educational forum that focuses on scams. The goal is to provide knowledge to people who want to educate themselves, find support, and discover ways to help a friend or loved one who might have been scammed.

In conclusion, while Netspend and similar prepaid card services can offer certain advantages, potential users must approach them with awareness. Thorough research, careful consideration of fees, and a proactive approach to security are vital. By staying informed and practicing caution, you can navigate the financial landscape and protect yourself from potential scams and fraud.